The Affordable Care Act (ACA / Obamacare) has been a polarizing issue since its inception and will continue to be so into the 2020 election. The ACA provides benefits for millions of American families, but the biggest winners, by far, are the private insurance carriers. Whether a candidate or their respective party argues in favor of ‘fixing ACA” or disbanding it altogether, know that they are both fighting to protect one group above all others – the insurance industry.

Healthcare in a Post-ACA World

The single greatest source for unbiased reporting and consumer-driven tools has been Kaiser Health, one of the few remaining non-profit health providers in the country. Kaiser launched several calculators to help consumers understand both their tax subsidy options as well as the effect of purchasing insurance contracts at every level.

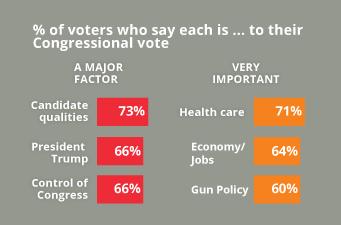

Today, they are focused on forwarding concerns of voters who express some of the same concerns before the ACA went into effect in 2013.

Chart courtesy of Kaiser Health, “Health Reform” https://www.kff.org/health-reform/

Kaiser continues to be a watchdog for consumers, clearly outlining what the insurance industry and our own Health and Human Services agency has not, that our national healthcare crisis has only gotten worse since 2013 when the Affordable Care Act was implemented as a national program.

Pulling Back the Curtain

In June of 2012, I had been hired by a major insurance company that wrote policies for consumers across five states. I was there because the case argued before the Supreme Court, National Federation of Independent Business v. Sebelius, was due for a decision and, if the mandate provision survived, it was my job to help them make up for 36 months of inaction and help them earn readiness certification for the inaugural Open Enrollment in October 2013.

Live coverage of the SCOTUS decision was broadcast on plasma screens in a lush conference room with state-of-the-art technology where senior executives had gathered to watch the announcement. Clearly they hoped to celebrate the death of what they viewed as a restrictive regulation. The room seemed decades removed from the claims processing floor far below where employees labored on refurbished computers still using unsupported Windows 95 software and critical processes centered around antiquated fax machine technology.

I sat in the back of the room looking at each person fidgeting nervously in oversized leather chairs, their brows furrowed, tight lipped, with the occasional polite nods to each other. They were focused on the screen, knowing that very little had been done to prepare for implementation outside of campaign contributions and lobbying activity after the law since passed two years before. In reality, virtually no preparations had been made at all, so sure were they that the Supreme Court, stacked with Conservative justices, would rule in their favor.

When the verdict was read live, the room erupted into angry outbursts and curses. Even in this sheltered executive area, screams and muffled shouts carried through from junior executives offices and a palpable shutter of fear and uncertainty rippled through the company as all worked stopped.

“The party is finally over,” I thought.

In reality, the Supreme Court decision added a new processing component for these insurance companies that required an overhaul of their databases to provide a seamless handoff to the IRS. They now needed to add line items for government imposed fines for noncompliance by consumers and new payment fields to accept the advance tax credits from the IRS to pay for monthly policy premiums.

Patient care codes for clinicians and hospitals were also being expanded to ten digit codes geared to properly designate the difference between an injury from a dog bite from a turtle bite. All of this simply meant greater expense for companies like this one wholly reticent to change.

The only employees that faced almost certain job losses where those thousands of minimum wage processors who had been tasked with denying consumers coverage or adding coverage exclusions in the old enrollment process. These conditions were listed over five full three-pages of health conditions deemed as unacceptable financial risks; everything from common seasonal allergies to thyroid conditions and heart disease; both the serious and the seemingly benign. All of these would now have to be covered by insurance contracts and that meant few of the denial processors would be needed in the future.

The real challenge to insurance carriers was having to make up for a decade of inattention to infrastructure, limping by on old technology and, at the same time, actually having to learn about who their consumers really were and do it all in less than a ten months.

The Myth And Miracle of the ACA

For the majority of Americans, the ACA, provides the critical protection for access to healthcare for those who can not otherwise qualify for Medicaid, afford private insurance, or get discounted coverage for chronic conditions. Lifting the restriction for ‘pre-existing health conditions’ coverage by insurers saved millions of Americans from added personal expenses of having to cover medical bills without the help of employer sponsored or private plans. Additionally, expanded access to Medicaid insurance policies for low income working families finally provided some protection for adults as well as children, but only in those states that opted to expand eligibility for working families who earned less than 150% of the Federal poverty level.

The real intention of the law was to rein in costs for the government and bolster the insurance industry with a massive influx of tax subsidies paid for by working Americans.

Understanding the difference between health insurance and access to healthcare has never been a priority for ACA advocates or detractors. They treat the two as inseparable and, therefore, necessary in any conversation about rising costs and the overall strategy to address a crisis issue for families. One side argues the ACA only needs to be refined and strengthened while the other rails against government mandated funding from state and federal taxes.

Both arguments are disingenuous to the real issue many Americans continue to face in a post-ACA era where costs still place a heavy barrier on true access to the health system consumers pay for:

- Workers with employer-sponsored insurance still cannot afford to use their insurance with high deductibles and added network costs when they need it while employers spend massive amounts of their funds on these group contracts.

- Small employers who do use the Healthcare.gov SHOP option to provide insurance must do so through an advance of up to 50% of the annual premium cost.

- Those in the direct ACA Marketplace are actually using their own tax refunds to bring the cost of monthly premiums down instead of collecting their tax overpayments as annual refunds.

- Consumers who opt for the cheaper catastrophic coverage are not fully protected financially and buy policies that offer limited benefits for just a few diagnosed issues.

- Those with Medicaid and Medicare plans are finding it harder to get access to hospitals that will accept their insurance while physicians themselves find it harder to stay independent and provide patient-centered care.

- The true cost savings reported through ACA by Health and Human Services come from reducing the payments to doctors and clinics who accept Medicare and Medicaid patients. http://www.healthaffairs.org/do/10.1377/hblog20150625.048781/full/

Let’s be clear on one major point- there is plenty of blame to go around on why the Affordable Care Act isn’t working for families. The law plan started with the same for-profit model that Democrats built upon from the idea borne of The Heritage Foundation, a right-wing think tank, in 1995. From there, Republicans in Congress proposed 98 different amendments that made it even worse. Pharmaceutical companies refused to even hold a conversation about reform, opting to walk away if regulation even came close to price negotiations.

The result of all of this back and forth is the national healthcare package we have today.

What You Pay For

The ACA did little to stem the cost of insurance policies. For insurance companies, it set limits on how fast prices could rise. The problem here is that the rule was left to the states to enforce through their own Department of Insurance review process. Some states, like Florida, opted to eliminate this office of review after ACA went into effect. Others approved rates that exceeded to rule at their discretion after insurance carriers complained about their rising costs.

For consumers, the ACA allowed those who qualified to get an advance on their federal tax return for the next year to pay for insurance premiums this year. These subsidies were really a load you made to yourself and you had to earn enough to even qualify for such a prepayment option.

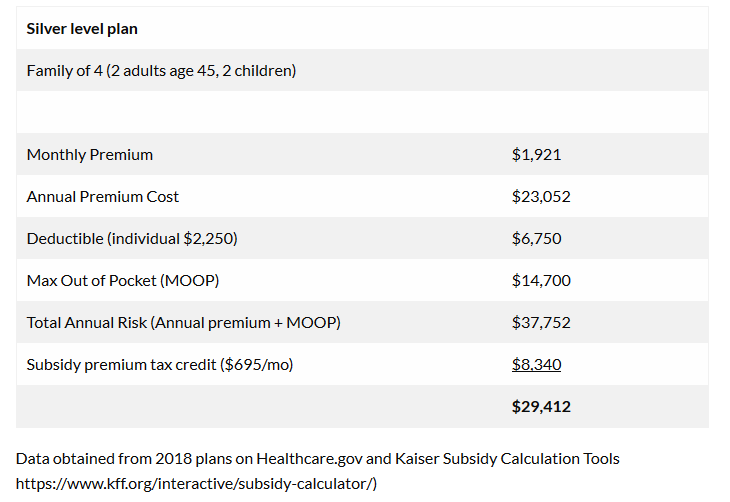

This still did not help consumers understand the complete financial risk they were agreeing to under these revised insurance contracts. For example, the cost of the plan per month is just the beginning of the financial obligation and just one part of the total annual risk. Add to this the deductible included in most plans and the total cost for insurance soars – even before you actually see a doctor.

This means your policy purchase is just access to the insurance carrier’s network at a discounted rate. Your policy does not even start working for you until you pay that deductible amount, too. For the average Silver Level plan in Illinois which covers 70% of your medical expenses after the deductible, this still leaves a family of four with a $23,052 insurance policy to pay for over one year. If they actually use that insurance, their cost rises exponentially with a total out of pocket risk of over $37,000. Even with a subsidy loan to themselves, they are still at risk for nearly $30,000 in medical expenses if they actually need to use their insurance to cover significant medical issues.

Insurance protects you when you go to doctors and hospitals that are in your insurer’s network. If you go to a doctor or hospital that is not in the network, you could end up paying much more. Most people do not need their insurance above minor events. This is why we are so unfamiliar with how these contracts really work.

But consider that if a state like Illinois spends just over $7,000 per Medicaid patient, why are we asking Illinois families to shell out $23,000 just to have a policy they can’t afford to use?

Controlling Costs

ACA only focused on controlling the cost for the government, not the consumer.

ACA helped restricts the growth of total Medicare spending by adding in reimbursement caps, the growth of Medicaid hospital spending, and (after 2018) the growth of federal tax subsidies in the health insurance exchanges to no more than the rate of growth of real GDP per capita plus about ½ of a percent. This means that as health care costs become more and more of a burden for the average family, they will get less and less help from government through time. – At a time when wages are not rising to meet ordinarily living expenses. http://www.healthaffairs.org/do/10.1377/hblog20150625.048781/full/

Many for-profit hospital groups are now adding obscure charges to pad their profit margins. One hospital group in Illinois took heat for adding a $275 charge to any patient bill coded as an administrative fee. Patients who were at the facility for routine follow-up care were shocked by the sudden rise in costs and became very vocal in their displeasure.

The ACA does allow hospitals to charge up to 60% more in administrative fees for standard services. The problem arises when these healthcare billing practices begin coding walk-in clinics and pop-up clinics as hospitals to pad charges. Unless you dispute the additional charge with the clinic and your insurance company, you may be on the hook for these excessive fees.

Cuts to Medicare as a Result of ACA

CMS sought to achieve quality outcomes by reducing reimbursement payments to providers. This doesn’t make sense for health outcomes.

“Decreasing healthcare expenditure has been one of the main objectives of the Affordable Care Act (ACA). To achieve this goal, the Centers for Medicare and Medicaid Services (CMS) has been tasked with experimenting with provider reimbursement methods in an attempt to increase quality, while decreasing costs.”

The Affordable Care Act’s (ACA) goals upon enactment were to slow the rising cost of healthcare and encourage a more efficient and higher – value health care delivery system (Sparer & Thompson, 2015). The best way to contain cost over the next five to ten years is through reformed provider payment to gradually decrease Fee– For- Service (FFS) payments (Ginsburg, 2013). http://mds.marshall.edu/cgi/viewcontent.cgi?article=1180&context=mgmt_faculty

For-Profit Insurance Carrier Model

In order to keep health insurance premiums as low as possible, the insurers are offering very narrow networks with limited doctors and hospitals included, which often leave out the best doctors and the best hospitals or offer higher deductibles than what most people are used to.

They know that healthy consumers buy on price alone, often ignoring other features of the plan. By keeping deductibles high and payments so low that only a minority of providers will accept their plans, the insurance companies are able to lower their premiums and still make a profit. The problem for consumers is a lack of choice and a risk of higher costs if they choose a health provider out of the network.

No Real Oversight

There is no real oversight on the Medical Loss Ratio (MLR) benefit. The ACA mandated that insurers had to cap profits at 20% – 25% to ensure most of what consumers paid was spent directly on health care. This same cap is applied to other private companies such as defense contractors. The idea being that, even for-profit private companies must be limited to a 20% profit margin when dealing with state and federal governments.

However, there is little oversight on this provision and it isn’t applied equally across states and the various insurance plans. The data is provided by the insurance companies themselves with no real auditing process in place. So, like projects that flow the Pentagon, money spent on the Insurance Industry cannot be effectively audited. http://www.naic.org/cipr_topics/topic_med_loss_ratio.htm

Consumer Penalties

The mandate required everyone to obtain insurance coverage or file a waiver. The intent was to incentivize people into being responsible and sharing the risk to bring cost down for the for-profit insurance companies. If they choose not to participate, it affects the profit margins for the insurance companies who then raise premiums for business and individual policyholders.

While some waivers are legitimately issues, other people are gaming that system easily. Some stop paying for insurance in September because the Federal government guarantees to cover premiums for 90 days. Others file a waiver and in 2016, 90% of the uninsured were exempt from the mandate altogether. Why?

Consumers were granted waivers for:

| American Indians | religious objections |

| Earning too little to be required to file an income tax return | Homelessness |

| Domestic violence | Being evicted from a residence |

| Having a utility cut off | Property damage from a fire or flood |

| Canceled insurance plan | Death of a close family member |

| Medical expenses resulting in substantial debt | Foreclosure |

| File for bankruptcy within the last 6 months |

Securing a waiver itself just means the consumer will not be subjected to high penalties imposed by the IRS during the tax season. It does nothing to protect them should they have a major health issue and need care without insurance. Hospitals need only ensure you are stable before turning you out on the street, even after a major surgery.

Consumer Access

Access to a Doctor

Insurer participation also declined in many areas, leaving more counties with only one insurer, which contributed to the high rate of premium growth for 2017, 2018. That’s a monopoly. Fortunately, Silver plans across IL14 largely stayed the same across the lowest priced Silver level plans because there has been one dominant carrier for several years.

Medicaid patients experience longer wait times for appointments, have more difficulty finding a provider who will treat them, have more trouble obtaining transportation, or have to wait longer at the provider’s site of care (MACPAC 2016b, 2016e). All of this with an insurance policy their own taxes helped pay for.

There is little recourse in fixing disparities as survey data is provided on a voluntary basis. For the Federal 2015/16 reporting year, few states returned survey data at all; only 20 reported on wait times, and just 19 on limitations disabled children and adults had in getting access to care. A few states looked at the overall number of providers in the state, but didn’t identify those serving Medicaid beneficiaries (15 states). Is that fair?

Outcomes and Care Can’t Be Measured

One stated purpose of ACA was to help improve health outcomes. The Hospital Readmission Reduction Program (HRRP) was intended to incentivise hospitals to improve the quality of their care through financial means. The HRRP imposes penalties on facilities when a patient is released but then has to return for the treatment for the same issue right away. High readmission rates are costly and indicate a hospital that may be cutting corners with their elderly Medicare patients. Facilities that reported rates higher than the national average for readmission of patients within 30 days for the same ailment are subject to a penalty of about 3% of their reimbursement cost.

This program does not apply to any patient under 65 years of age, or the Medicare eligibility age. This criteria on age and plan eliminates the benefit for millions of Americans who could have been served through quality initiatives, but no adequate measures have been put in place nor have private insurance companies agreed to participate.

Bait & Switch, Plans and Networks are not the same

Remember, insurance protects you when you go to doctors and hospitals that are in your insurer’s network. If you go to a doctor or hospital that is not in the network, your fees are higher and raise your total out of pocket expenses exponentially. The situation is worse in rural areas where access to doctors in an carrier’s network can be scarce or incorrectly reported.

In 2014, a court ruled that one major insurance carrier had to allow consumers to switch plans after Open Enrollment closed because the network of doctors and hospitals listed on the insurance company’s website was not accurate. This lead to many consumers unknowingly buying plans that had no hospitals or health providers within a 20 mile radius. Worse still, the company knew their data was not being reported accurately to consumers during the initial enrollment period which began on October 1, 2013.

For Medicaid patients, this situation has grown increasingly worse as in-network provider lists shrink. One study of Medicaid managed care providers conducted by the Office of Inspector General (OIG) of the U.S. Department of Health and Human Services found that about 33 percent of contracted providers could not be found at the location listed by the plan; another 8 percent said that they were not participating in the plan; and an additional 8 percent were not accepting new patients (OIG 2014a)

Doctors Limit Accepting New Medicaid Patients

In Illinois, nearly 1.5 million of the people on Medicaid are children, nearly 200,000 are seniors and about 230,000 are adults with disabilities.

More than 3 million Illinois residents — about 1 of out of every 4 people in the state — have health insurance through Medicaid, which is funded by state and federal dollars. (Chicago Tribune 2017)

Prior to 2015, there was a 10 percent payment bonus to healthcare providers to incentivize then to accept new Medicaid patients, but these bonus payments ended in 2015. Today, doctors who wish to remain independent are forced to accept a reduced 48% payment to care for Medicaid recipients which means choosing between keeping their doors open and seeing those most in need.

The Urban Institute published findings from a study, Medicaid Physician Fees after the ACA Primary Care Fee Bump in 2017 which noted, “Removing the added 10 percent reimbursement rate after 2015 predictably showed that of the 85 percent of doctors accepting new patients, only 65 percent accepted Medicaid covered patients.”

In Illinois, the Medicaid reimbursement rate is roughly .80 of private insurance reimbursement rates. Without the added 10 percent Federal incentive payment, few providers are willing to take on lower paying patient accounts. That means getting access to a doctor for Medicaid patients is much harder and wait times are far longer.

Additional sources:

https://www.macpac.gov/wp-content/uploads/2017/03/Monitoring-Access-to-Care-in-Medicaid.pdf

For-Profit Care Models

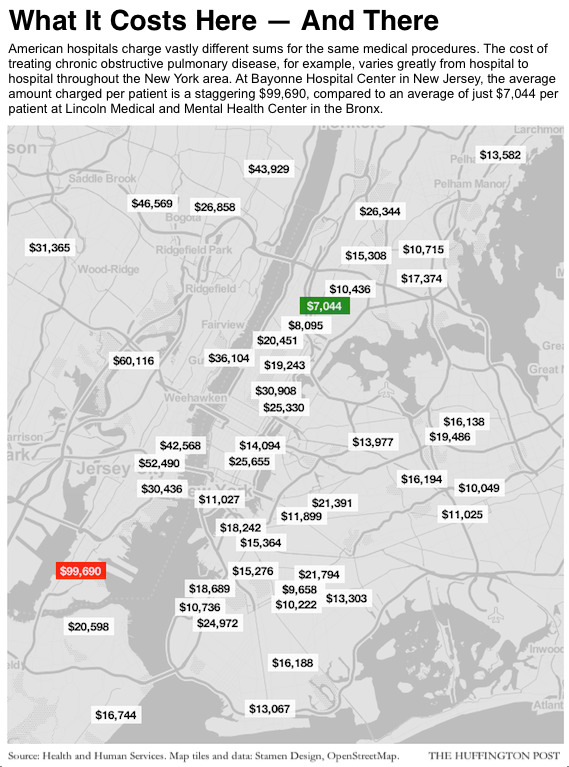

Under the non-profit model, hospitals based their pricing on the actual costs of services, procedures and overhead, while adding on some measure of profit to allow the facilities to invest in bettering their offerings. It is no longer that simple as hospitals now artificially raise their rate card charges as a part of the negotiation process they enter into with private, for-profit health insurers.

The ACA law did nothing to limit these excessive charges across geographic locations. Health and Human Services did release a list of comparative cost for Medicare consumers, but expected consumers to comparison shop on their own.

Hospitals simply doubled their rates for procedures to then arrive at the insurance company’s negotiated discounted rate, to make sure sure they still retained a wide profit margin. They also include fees to cover non-payments from uninsured patients. The ACA law does little to address this trend nor does it offer discounts through negotiated drug pricing.

Jonathan Blum, Director of the Center for Medicare was quoted in a Huffington Post as saying,“What drives some hospitals to have significantly higher charges than their geographic peers? I don’t think anyone here has come up with a good economic argument.” This means that consumers still have very little protections from state and federal agencies tasked with just such oversight of the industry.

Drug Prices Unchecked

Bloomberg found that Merck gets more than twice as much in the U.S. for a monthly supply of the same drug as in Canada, the next most costly place to buy it. Likewise, Bloomberg reported that Humira, AbbVie Inc.’s rheumatoid arthritis treatment, costs an estimated $2,500 a month in the U.S. after discounts, compared with about $1,750 in Germany. Prices were found to be even lower in other nations around the world.

Their analysis also found that Roche Holding AG’s Herceptin breast cancer drug, after rebates of roughly 15 percent, still cost about 85 percent more in the U.S. than in other high-income countries, and a third more than in Saudi Arabia, where the price is highest after the U.S.

Sources: https://www.bloomberg.com/graphics/2015-drug-prices/

Video: https://www.bloomberg.com/news/videos/2015-11-09/why-do-drug-prices-keep-going-up-

Going back to an income-based model that left so few covered is not an option. Staying with ACA is also unsustainable. This is why proposals like Medicare for All are becoming popular alternatives that allow the United States to join the rest of the industrialized world in helping every citizen gain access to healthcare.

Meeting Consumers

Prior to the final SCOTUS ruling, the insurance industry focus had been on contract law and billable care codes, or raw data and morbidity statistics measured over profit margins. No insurance company profited by paying claims. Rather, the target was to collect more monthly premium dues and limit the amount paid out to clinicians in patient care.

Very little attention went into the consumer’s focus. In fact, one of the smallest departments within the company was the Consumer Advocacy group, a mere handful of employees tasked with addressing complaints from customers who disputed denials for coverage or overcharges. Now, employees and executives alike needed to understand real people, their customers, in ways they hadn’t before – as individuals and families who did not understand the very nature of the product they were buying – a service contract.

Today, these departments haven’t grown much, but are now flanked by Consumer Care Advocates, professionals tasked with keeping costs low by reminding policy holders to schedule annual wellness visits and take their medications as prescribed. Preventative measures in healthcare, they know, save money.

The ACA did limit insurance carriers to a 20% profit margin per policy, but there were built in loopholes to exploit for profitability. This meant that marketing budgets would be tied to lobby activity in earnest and Washington D.C. offices have enjoyed a period of rapid expansion. This investment means better legislative opportunities for a Congress that neither read nor fully understood the original ACA law nor have forwarded solid ideas on just how they plan to “fix it” or “repeal and replace it”. One insurance industry giant with very deep pockets and a family-friendly brands engaged in lobbying activity worth over $23 million dollars in 2012. That spending has remained steady, surpassed only by political spending of $27 million during the 2016 election cycle. They contribute equally to Democrats and Republicans as well as to PACs. Industry-wide, the total spent on lobbying activity rose to $320 million dollars during that same same election cycle. (Data courtesy of www.opensecrets.org. Complete data for the 2018 MidTerm elections will be available in December. )

Today, the headlines continue to focus on consumers reeling over rising costs and changes to insurance coverage networks. They focused their ire at government officials or the opposing political parties, not realizing all of these points were at largely managed at the discretion on the insurance companies themselves.

Even the infamous line, “You can keep your doctor,” uttered by former President Obama gets more airtime than the truth of the matter – it is the insurance company that controls their own network, not the government. Sometimes even they aren’t adequately reporting the full scope of their own networks, causing more problems for consumers.

One company in 2014 was court ordered to allow consumers to switch policies after the official ACA Open Enrollment had closed because so many new policy holders found out they hadn’t purchased what they were told they were getting. The company had listed robust networks of hospitals, doctors and treatment specialists when the truth was their policies had little actual coverage in some areas.

An Alternative to Consider

Seema Verman, Administrator for the Centers for Medicare & Medicaid Services (CMS) sent this tweet out prior to the 2018 Midterm elections.

Administrator Seema Verma, who currently earns a six figure salary (EX-03 ranked top 10% percentile federal employee) as the head of the Centers for Medicare and Medicaid Services enjoys access to healthcare courtesy of the CMS executive benefits package. She admitted in a September statement that the burden of rising cost for consumers was unsustainable:

“By 2026 one in every five dollars spent in our economy will be on healthcare. For government, this means that healthcare spending will crowd out funding for other priorities like national defense, education, public safety, and infrastructure. For businesses this means that they will no longer be able to invest in growth or create jobs, and for all of us this means that our household budgets will be stretched even further because of higher premiums and copays.“

Her answer to this challenge was simply innovating processes. This statement followed a Koch backed study published by the Mercatus Center at George Mason University which showed proposals like Medicare for All would actually control costs and reduce the overall burden on the national debt by controlling costs and eliminating the insurance industry altogether.

Senator Sanders celebrated the news with a tongue-in-cheek statement, saying, “Let me thank the Koch Brothers of all people for sponsoring a study that shows that Medicare for All would save the American people $2 trillion over a 10-year period…”

Proposal like the one from Senator Sanders are gaining support across the country from Americans of all ideological backgrounds. A recent Reuters survey showed 70% of respondents in favor of the plan. The core driver for renewed interest is cost and a critical need for access to care apart from insurance contracts.

This ideological fight played out in the 2018 Midterm elections amidst growing concerns for access to affordable healthcare. Very little has changed in the last five years to better control real consumer expenses. Meanwhile the Open Enrollment period for ACA plans has been reduced to just a few weeks from the original three month period and advertising dollars have been cut. All while few agencies apart from Kaiser Health continue to try educating a populace caught in the middle.

Republicans in Congress have once again threatened to cut Medicare and Medicaid as a consequence of their tax plan and deficit spending. And now those on the left hope that 2018 victories in the House of Representatives will stall these and other draconian measures proposed by the Trump Administration.

But, to what end?

The obvious choice to remove government intervention and retain fiscal savings while also addressing the need for access to healthcare may very well be in a Medicare for All plan. This is the conversation lawmakers need to consider to ‘repeal and replace’ or ‘fix’ the ACA.

The insurmountable problem no one is talking about is that the ACA itself was a bad compromise, trading tax dollars in corporate subsidies for limited consumer protections in a way that has always been wildly out of balance. In the end, the American consumer got less than they deserved and has continued to pay a heavy price for the privilege.